Core Properties LLC is making waves in St. Louis by offering a hassle-free solution for homeowners looking to sell their properties fast for top cash offer. AS SEEN ON:...

READ MOREIs Selling Parents House to Pay for Care Necessary?

Question: My parents own their house outright, but would like to know if it could be owned in four names – that is, those of my parents and their son and daughter (me) – I do understand that we would need to change the deeds and we would incur a cost for doing so. They...

READ MOREHow do I sell my house quickly? Sell my home in St Louis. Cash Home buyer Near Me in Saint Louis

How Do I Sell My House Quickly New job opportunity just came up? Changes in your finances or relationship? Want to be closer to family? These might be a few of the reasons you need to sell your house quickly. Today we’re going to discuss how we at Core Properties can help make that happen for...

READ MORESell My Foreclosed Home to Cash Home Buyer

Have you found yourself facing foreclosure on a home in St. Louis, MO and don’t know what to do? Foreclosure on a home occurs when the homeowner falls behind on their mortgage payments and the bank or mortgage company repossesses the ownership of the home. Finding yourself in this situation can be overwhelming and...

READ MOREHome Buyer Near Me in Ferguson, St. Louis, MO

We Buy House in Zip Code: 63135 Chambers Rd., Airport Rd., Ferguson Ave., South Florissant Rd., Hudson Rd., North Elizabeth Rd., South Elizabeth Rd., Hereford Ave., Powell Ave., Bermuda Dr., Frost Ave. Get a fair, all-cash offer for your house in Ferguson, St. Louis Missouri WE BUY HOMES in Ferguson, St. Louis, Missouri Core...

READ MOREHome Buyer Near Me in University City, St. Louis, MO

We Buy House in Zip Code: 63130 Delmar Ave., Page Ave., Hanley Rd., North and South Rd., Midland Blvd., Olive Blvd., Kingsland Rd., Pennsylvania Ave., Groby Rd., 82nd Blvd. Get a fair, all-cash offer for your house in University City, St. Louis Missouri WE BUY HOMES in University City, St. Louis, Missouri Core Properties...

READ MOREHome Buyer Near Me in Bellefontaine, Glasgow Village, St. Louis MO

We Buy House in Zip Code: 63137 Bellefontaine Rd., Lewis and Clark Blvd., Chambers Rd., Lilac Dr., Riverview Dr., St. Cyr Rd., Shepley Dr., Coburg Lands Dr. Get a fair, all-cash offer for your house in Bellefontaine, Glasgow Village, St. Louis Missouri WE BUY HOMES in Bellefountaine, Glasgow Village, St. Louis, Missouri Core Properties...

READ MOREHome Buyer Near Me in Afton, St. Louis, MO

We Buy House in Zip Code: 63123 Gravois Rd., Tesson Ferry Rd., Grant Rd., South Rock Hill Rd., Pardee Rd., South Laclede Station Rd., Mackenzie Rd., Weber Rd., Heege Rd., Baptist Church Rd., Musick Rd. Get a fair, all-cash offer for your house in Afton, St. Louis Missouri WE BUY HOMES in Afton, St....

READ MOREHome Buyer Near Me in Lemay Ferry, St. Louis MO

We Buy House in Zip Code: 63125 Lemay Ferry Rd., South Broadway, Reavis Barracks Rd., Telegraph Rd., Kingston Rd., Sappington Barracks Rd. Get a fair, all-cash offer for your house in Lemay Ferry, St. Louis Missouri WE BUY HOMES in Lemay, St. Louis, Missouri One of the key advantages of selling to our cash...

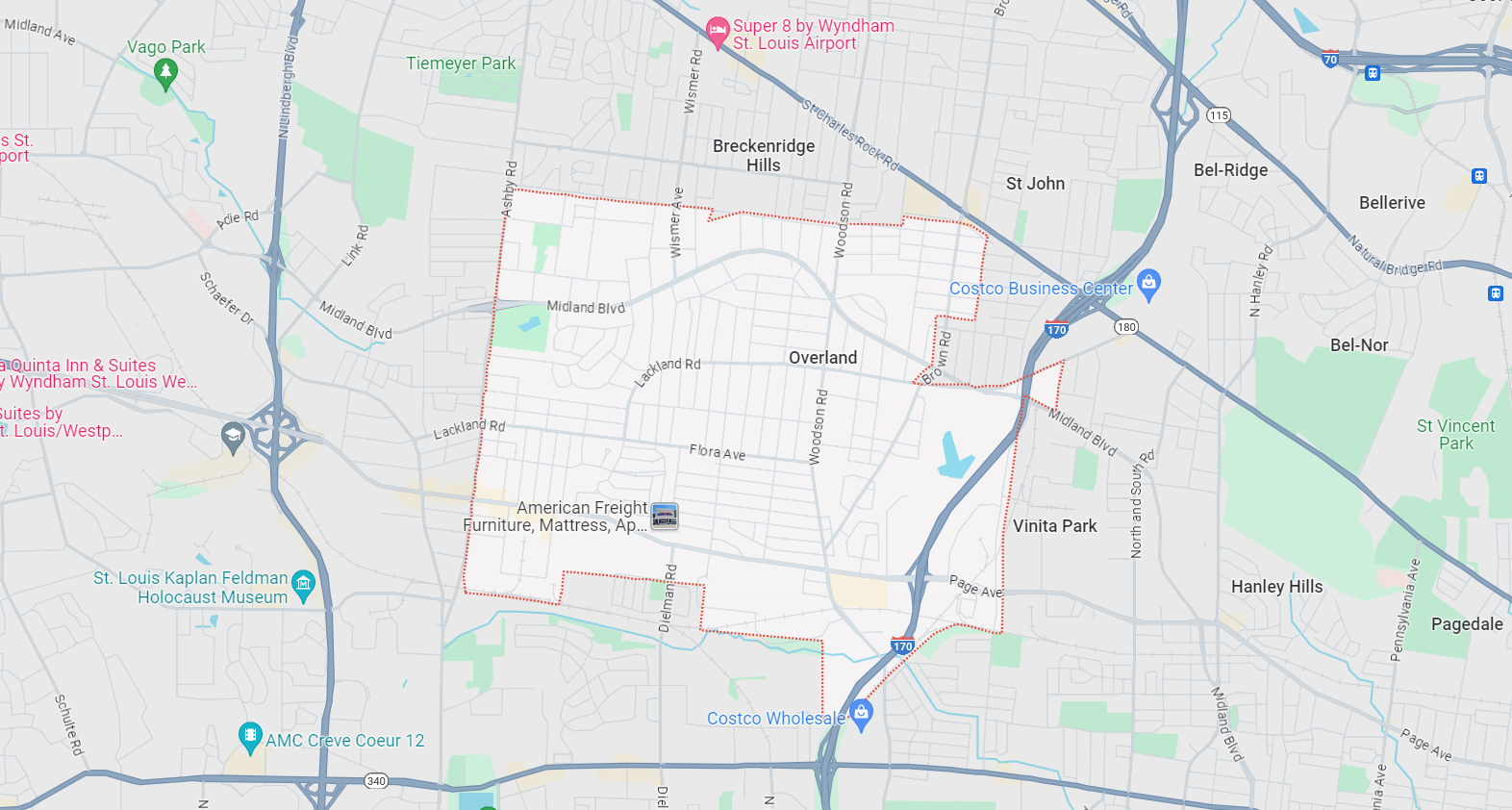

READ MOREHome Buyer Near Me in Overland, St. John, Breckenridge, St. Louis MO

Home Buyer in Zip Code: 63114. WE BUY HOUSES FOR CASH Page Ave., Woodson Rd., Ashby Rd., Midland Blvd., Lackland Rd., Brown Rd. Get a fair, all-cash offer for your house in Overland, St. John, Breckenridge, St. Louis Missouri WE BUY HOMES in Overland, St. John, Breckenridge, St. Louis Welcome to our reputable cash home...

READ MORE